Financial statements of a company include important information such as debt, revenue, profit, etc. Analyzing this information in different ways.

Among them, profitability ratios are the key financial metric that delivers financial stability and forecasts the future growth of a company.

What is Net Profit Margin?

Net Profit Margin, also known as ‘Net Profit Margin Ratio’ or ‘Net Margin’ is a profitability ratio used to calculate how much net profit is earned by a company as a percentage of its total revenue.

The net profit margin gauges how much per rupee in revenue obtained by a company converts into profit.

The net profit margin is equal to the net profit which is expressed as a percentage.

The net profit margin is an important financial ratio that measures the financial health of a company.

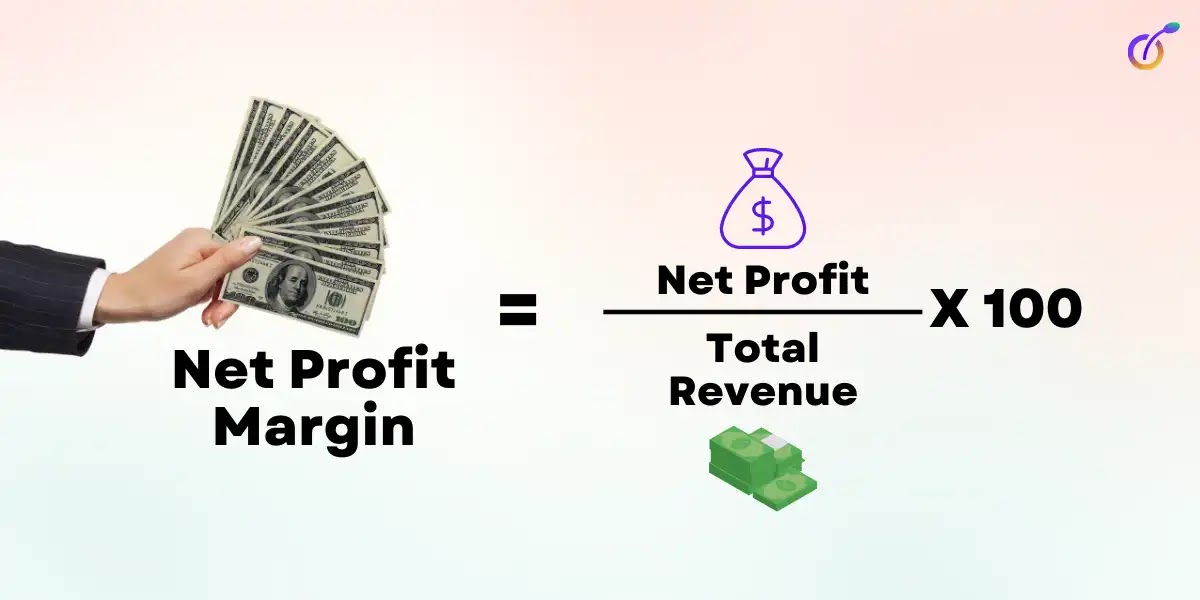

How to calculate Net Profit Margin?

Calculate the net profit margin of a company that assists investors and measures the percentage of net profit generated from its total sales or revenue. The net profit margin is calculated by dividing the net profit by the revenue.

After that, the result is multiplied by 100 to get the number as a percentage.

The net profit is calculated minus all the company’s expenses including operating costs, interest, and taxes from its total revenue.

These items are listed on the company’s income statement or profit and loss statement.

Therefore, the net profit margin formula is below,

Net Profit Margin = (Net Profit / Total Revenue) * 100

Hence, the net profit margin can be negative or positive as a percentage. A negative net profit margin portrays the company as unprofitable during the financial year.

On the other hand, a positive net margin means the profitability for a particular period of a company.

Example for Net Profit Margin

Suppose, it is an ABC company. Here is some information about ABC company.

The income statement for the year ended on 31.03.2022

| Particular | Amount |

|---|---|

| Revenue | 10,00,000 |

| Others Income | 500,000 |

| Total Income | 15,00,000 |

| Expenses | |

| Salaries | 300,000 |

| Finance Cost | 150,000 |

| Utilities | 90,000 |

| Inventory | 210,000 |

| Total Expenses | 750,000 |

| EBT | 750,000 |

| Tax @ 30% | 225,000 |

| Net Profit | 525,000 |

ABC company’s total revenue of 10,00,000 as per the income statement and net profit of Rs. 5,25,000

Therefore, Net Profit Margin = (5,25,000 / 10,00,000) * 100

Net Profit Margin = 52.5%

Hence, a 52.5% net margin means for per 1 rupee of revenue the company generates 0.525 in net profit.

How to interpret the Net Profit Margin Ratio?

The net profit margin ratio is used to measure the percentage of net incomes remaining once all operating and non-operating expenses have been deducted from the total sales earned in the financial year.

The net margin can assist the investors to compare the company's performance and among its competitors during a financial year.

The net profit margin ratio is the most effective ratio to evaluate the overall performance of a company and is identified as a percentage.

It is important to keep in every investor’s mind that a single number in a company report is seldom enough to indicate the performance of the overall company.

If a company is increasing its expenses to increase sales volume, it might cause a loss of a company.

Similarly, a decrease in sales volume might further increase profit if a company is tightening its expenses.

A high net profit margin indicates that a company is effectively managing its costs and/or delivering goods and services at a significantly higher price than its costs.

Hence, a high net margin can result from competent management, low costs, and robust pricing power.

A low net profit margin measures that a company has failed to control its cost and/or strong pricing strategies.

Therefore, a low ratio can result from inefficient management, high expenses, and pathetic pricing strategies.

In general, investors shall look at the trend of net profit margin over the years while analyzing and need to see the numbers from the profit margin ratio as overall indicators of a company's profitability performance.

Hence, investors should analyze a company in depth.

Net Profit Margin vs. Gross profit margin

The gross profit margin is an important ratio that measures the profitability of a company. The gross profit margin is the amount remaining after deducting the accounting for the cost of goods sold and calculating the gross profit margin as a percentage of revenue.

The cost of goods sold measures the cost of raw materials and labor which are directly associated with the primary product of a company.

It eliminates indirect costs such as rent, utility, marketing, and accountancy.

The gross profit margin is calculated by diving gross profit by revenue. The gross profit margin is helpful to track how much percentage of profit is earned from the production of a company’s goods. The gross profit margin, on the other hand, is a profitability ratio.

What are the limitations to Net Profit Margin?

While computing the net profit margin ratio of a company, investors try to compare the number with their peers or competitors to determine which business is doing best for their investors.

In general, the net profit margin ratio is not the right computation for comparing companies in different industries.

Because some industries have a lower net profit margin ratio is considered quite good and some industries have a higher net profit margin ratio is considered the norm.

For example, companies in the automobile industry may have a greater profit margin ratio and lower revenue growth.

On the other hand, companies in the food industry may report a lesser profit margin ratio and greater revenue.

Therefore, it is always advisable to compare companies within the sectors.

Another limitation of the net profit margin ratio is that it can have a great deal of effect on reporting time due to the probably oversized influences of one-time events.

The asset sales of a company can increase the income in short and inflate the net margin. Similarly, one-time costs can very much affect a company's profitability for a reporting period.

Therefore, it is important to calculate the net profit margin whether it gives appropriate value or not during any financial year.

What is a good profit margin?

A good profit margin may vary from industry to industry. Hence a rule of thumb, a net profit margin ratio of 10% is considered average, a good profit margin of 20% is considered good and a 5% margin is low.

But investors should deeply evaluate companies within the industry and also look at other factors.

Conclusion

The net profit margin is one of the most crucial metrics that investors can use to analyze a company do not use the ratio alone because a single ratio cannot give a clear scenario about the company.

Post a Comment